Introduction to Special Economic Zones (SEZs) in Laos (Part 1)

Mar. 11, 2021, 04:05 pm.Special Economic Zone (SEZ) is a haven for investors, in which the business and trade regulations are different from the regular economic zone, levitating trade balance, employment, increased investment, job creation, and effective administration. As Laos determined to graduate from the least developed country, these SEZs are the driving force to the prosperity in the country. Currently, there are 11 SEZs in Laos operating across the country, as well as open to general and promotional investment. In this article, we'll look into six SEZs that are formed and operating in Laos.

1. Savan-Seno Special Economic Zone (2003)

The first SEZ of Laos, established in 2003. Located in Savannakhet where the second Lao-Thai Friendship bridge is stationed, with notable factories erected here in this area like Thailand’s Mitrpol sugar factory and Nikon factory. Placed along Road No.9 as a part of the East-West Economic Corridor, with a total investment of $74,000,000 from the government. The zone targets various sectors such as service, logistics, industrial, and trade.

There is also Tax Incentives by Sector for those who are interested in investing in this SEZ, with Services sector will be granted the exemption of profit tax for a period 2 – 10 years, Trade sector for 2 – 5 years, and Industrial sectors for 5 – 10 years, after that there will be 8% - 10% corporate profit tax will be based upon investment capital.

2. Boten Beautiful Land Specific Economic Zone (2003)

Where the on Laos - China border set, located in Luangnamtha. This area is where the abundance of casinos, clubs, and malls erected, making this zone look like you are in another country. Furthermore, this special zone will be reachable through the newly developed express highway in 2022. in 2003 with an investment of $500,000,000 from a private Chinese company, strategically placed adjacent to Road A3 as a strategic route to connect to ASEAN+3 (China, Korea and Japan). This SEZ has been establishing investment projects like agriculture, 5 Star Hotels and Resorts, education institution, public health centers, business and trade areas.

3. Golden Triangle Special Economic Zone (2007)

Border with Thailand, Myanmar in Bokeo province as one of the Golden Triangle, taking over 3,000 hectares of the area. This area is where the infamous “China Town” placed, due to the majority of people who settle here are Chinese. This zone is a joint investment from the government and Chinese private company for $86,600,000. It comes with investment projects such as economic infrastructures, agriculture, livestock, hotel, residential area, and real estate.

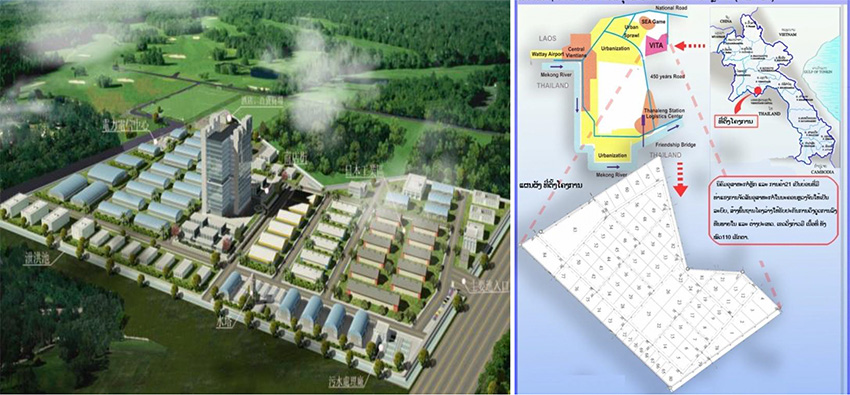

4. Vientiane Industrial and Trade Area (VITA Park) (2011)

Located 22km from the city of Vientiane Capital, with 100 hectares of the area and the investment of $43,000,000 from the government and a company from Taipei. The targetted investment projects are Industries like Textile, Electronic Parts, Retail Store, Trade Center, Training Center, School and Hospital. VITA Park also provides the special courtesy and tax incentives afforded to businesses located within the area.

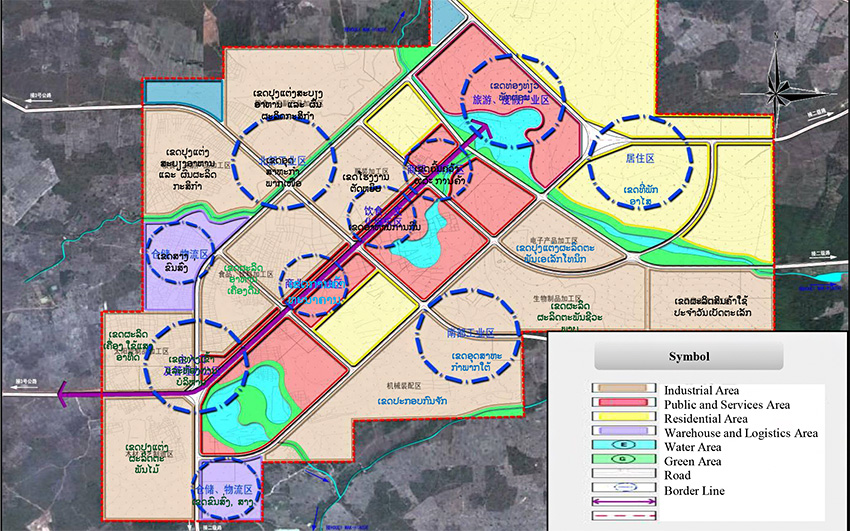

5. Saysetha Development Zone (2010)

Set in Vientiane Capital, taking 1,000 hectares of the area, another investment from the Lao government and a Chinese company. Set to be the New City in Vientiane. Located on the north No. 13 National Highways and the south 450th Anniversary Avenue. Furthermore, it is 14 km from Lao-Thai Friendship Bridge and 19 km away from Wattay International Airport. Developing investment projects of industries like agriculture, wood manufacturing, light industry, tourism-services, electric appliance, machinery, and new energy.

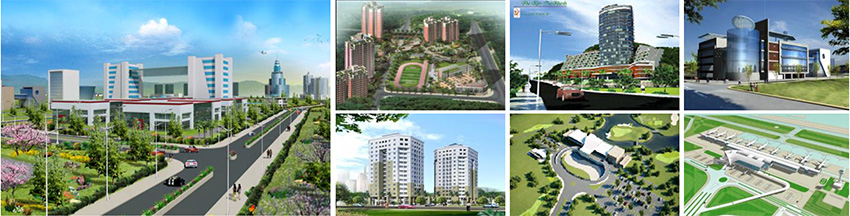

6. Phoukhyo Specific Economic Zone (2010)

Set in Khammuane province, located 14 km from the Third Lao-Thai Friendship Bridge and close to Road No.12 as the main route to Voung Anh deep Sea Port in Vietnam, taking 4,850 hectares of the area, with the investment projects such as commerce and industries, business buildings, sports parks, airport and logistic sector, education Sector and hotel and entertainment sector. This zone also provides Tax Incentives by Sector where Finance, Education and Public Health sector will be granted the exemption of profit tax for 3 – 6 years, Tourism, Sport and Agriculture sector for 3 – 7 years, rade, Transportation and Services sector for 3 – 8 years, Light Industries sector for 3 – 9 years and Industries sector for 3 – 10 years. Afterward, there will be corporate profit tax for each sector ranges from 3% - 8%

To Be Continued

ລາວ

ລາວ  English

English  简体中文

简体中文  français

français  ไทย

ไทย